DeFi is hot these days. What is DeFi? DeFi, an acronym for “decentralized finance”, refers to the provision of traditional service offerings (e.g. lending and borrow, trading and even insurance) in a decentralized manner on the blockchain. The system does not depend on any centralized authorities. Stakeholders in the DeFi system typically try to build a permissionless ecosystem.

There are many notable players in different niche applications. Let us give you some examples: Maker, Compound and AAVE are among the leading DeFi players in crypto lending and borrowing; Uniswap, Curve, Balancer, 1inch are among the leading DeFi players in providing liquidity in decentralize crypto exchanges (DEXes); Synthetix and Uma are among the leading DeFi players in synthetic crypto assets.

The majority of these DeFi ecosystems were built using the Ethereum ecosystem. As many transactions on DeFi may involve more complicated steps than just sending and receiving cryptos, they may require more gas fees to process. As everyone probably knows, gas fees on the Ethereum network skyrocketed over the past few months. Some DeFi actions may cost well over 100 USD to process when gas fees are high.

High transaction fees likely have pushed many retail investors away from participation in the DeFi ecosystem. This is actually not good for DeFi to have wider adoption in our financial system. However, this is not really the end of the world as CeFi may come to rescue (at least temporarily). CeFi platforms may play the role of pooling and channelling retail investors into the DeFi ecosystem so that the high transaction costs can be shared by a much larger dollar value of transactions.

After our own trials and experimentations, we identified at least three CeFi exchanges that have provided such pooling services for retail investors.

Binance Earn

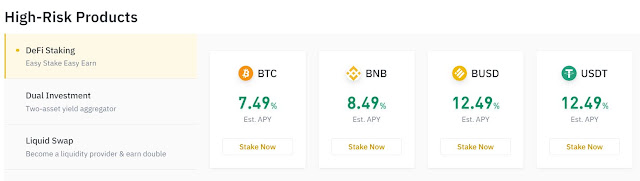

Under Binance Earn, you can find a section called “High-Risk Products”. One of the selections is called “DeFi Staking”.

If you enter the section, it will list all the DeFi protocols that Binance currently supports. These include Curve (BTC, BUSD, USDT, BNB), Compound (DAI), and Karva (BNB). The highest yielding ones are for USDT and BUSD on Curve (often staying around 12% APY) but these were almost always sold out.

The minimum entrance amount is about 100 USD. And in most cases, the locking is flexible. That means one can withdraw and redeem whenever they want (but usually with one day of processing time). This should really help lower the entrance barriers for retail investors in participating in DeFi.

However, Binance US does not provide the same DeFi intermediary services. Only folks outside of US can take advantage of this DeFi service on Binance.

OKCoin Earn

Currently the most reliable platform that offers access to all is OKCoin. Under OKCoin Earn, OKCoin claims that it the first licensed exchange to simplify DeFi and make it accessible for all investors. OKCoin also claims to be the first to offer DeFi without fees. Specifically, OKCoin states that it covers the transaction (gas) fees that other platforms typically charge to access these protocols!

With OKCoin Earn, investors can deposit their stablecoin assets into DeFi permissionless liquidity protocols to earn up to 5-20% annual percentage yield (APY). Protocols available in Earn include YFI and Compound currently in March. OKCoin supports three stablecoins, including DAI in Yearn Finance (YFI) and Compound, USDT in Compound, and USDC in Compound.

The term is flexible so you can withdraw anytime (usually processing time is within one day). Minimum amount to deposit is only 50 USD, even lower than that of Binance. The DeFi service for Compound at OKCoin gives you a more authentic DeFi services in that you earn both in kind as well as COMP as bonus payments. If you are bullish about COMP, this could be a great place for you!

We played around with staking both USDC and DAI using Compound protocol at OKCoin. However, we didn’t try out using the Yearn Finance (YFI) as the instruction mentions that that there is 0.5% charged by the YFI platform during withdrawal. For the Compound protocol at OKCoin, it is completely fee-free and the experience is seemingless. We have really enjoyed our DeFi experiences at OKCoin with the Compound protocol.

OKCoin Earn also offers another interesting product called Stacking. It allows you to earn BTC when you “stake” STX in the Stacks protocol. We may cover it in another article after experimenting with it a bit more. Besides giving out $10 worth of BTC referral bonus, OKCoin is currently having 7 additional promotional activities that may give you additional free BTC, AVAX, ALGO, DOT, STX in late March of 2021!

HOTBIT Earn

The last CeFi platform we are going to introduce in this article is the HOTBIT exchange. Note that this is a more obscure exchange than the first two. It is unclear who the founder of this exchange is. Neither can we find out where exactly the exchange is currently registered or headquartered. Judging from the choice of English words used on the exchange, we believe that the main operations of HOTBIT is in China.

Nevertheless, HOTBIT provides probably the most comprehensive listing of cryptos. Despite the risks of opacity, HOTBIT does offer interesting investment products. Some of the investment products allow retail investors easier access to DeFi protocols as well.

For example, for USDT alone, HOTBIT offers flexible savings at interest rate of 3.72% APY. The rate is not attractive compared to most CeFi platforms. However, it offers four other investment products that are much more attractive in terms of yields, ranging from 16% to 21% APY. One of the investment product is called “USDT DeFi Smart Pool”, that allows retail investors to gain DeFi exposure at a minimum amount of only 10 USDT!

We have tried it out and tracked the yield for a while. The DeFi yield for USDT at HOTBIT was ~25% APY in February 2021 and ~20% APY in March 2021. The yield is definitely pretty decent and is generally higher than CeFi platforms. In the product highlights, it means that there is a service charge that equals to 10% of the profit. However, we are not sure if the 20.66% APY shown is net of the service charge fee or not.

It is quite nice that the DeFi payout at HOTBIT is shared with you on a daily basis. One can easily check the payout on its web interface or on the mobile app. We have tried out depositing 50 USDT into the HOTBIT USDT smart DeFi pool in late February. In a month, our total income reaches almost 1 USDT. Each day, it is generating between 0.025–0.035 USDT as income.

At the moment, we have found that HOTBIT currently probably offers the highest yield on Ethereum (ETH) as well as offers among the highest yield on Bitcoin (BTC). The yield for Ethereum (ETH) has been in the range of 21%-25% APY while the yield for 9%-10% APY. These yields are higher or at least as high as the best yields offered by any of the high-yielding CeFi platforms such as BlockFi, Celsius Network, ApyHarvest

However, due to the obscurity of the exchange, we do not recommend folks to HODL a lot of cryptos on HOTBIT. It may be a good place to diversify a bit of your holdings but it is not advisable to put too many in obscure CeFi platforms.

Comments

Post a Comment